Resolv Reveals RESOLV Tokenomics Ahead of May TGE –

DeFi platform Resolv publishes its detailed token economic model, prioritizing community incentives, utility, and protocol security in preparation for its upcoming Token Generation Event (TGE).

In a move that further positions itself among the more structurally sound DeFi projects in 2025, Resolv has officially unveiled the tokenomics of its native token, RESOLV, providing a clear and methodical breakdown of supply, utility, and distribution mechanisms. The announcement comes ahead of its Token Generation Event (TGE), scheduled to begin registration in the first half of May.

Strategic Token Allocation Reflects Governance and Growth Priorities

At the heart of Resolv’s token model is a fixed total supply of 1 billion RESOLV tokens, distributed across four key sectors. This strategic distribution underpins Resolv’s intent to balance protocol sustainability with equitable community rewards:

- 10% will be allocated for airdrops in Q1, serving as the project’s initial community engagement lever.

- 40.9% is reserved for ecosystem growth and community-building, reinforcing long-term participation incentives.

- 26.7% is designated for teams and contributors, a standard practice for rewarding internal development while imposing multi-year vesting to prevent short-term sell pressure.

- 22.4% is allocated to investors, likely reflecting seed and private funding rounds aimed at bootstrapping liquidity and infrastructure expansion.

This allocation strategy shows deliberate foresight. By directing nearly half the supply toward ecosystem and user-focused initiatives, Resolv is emphasizing decentralization and adoption over short-term investor enrichment—a notable stance given the current trend of aggressive vesting dumps that plague many DeFi token launches.

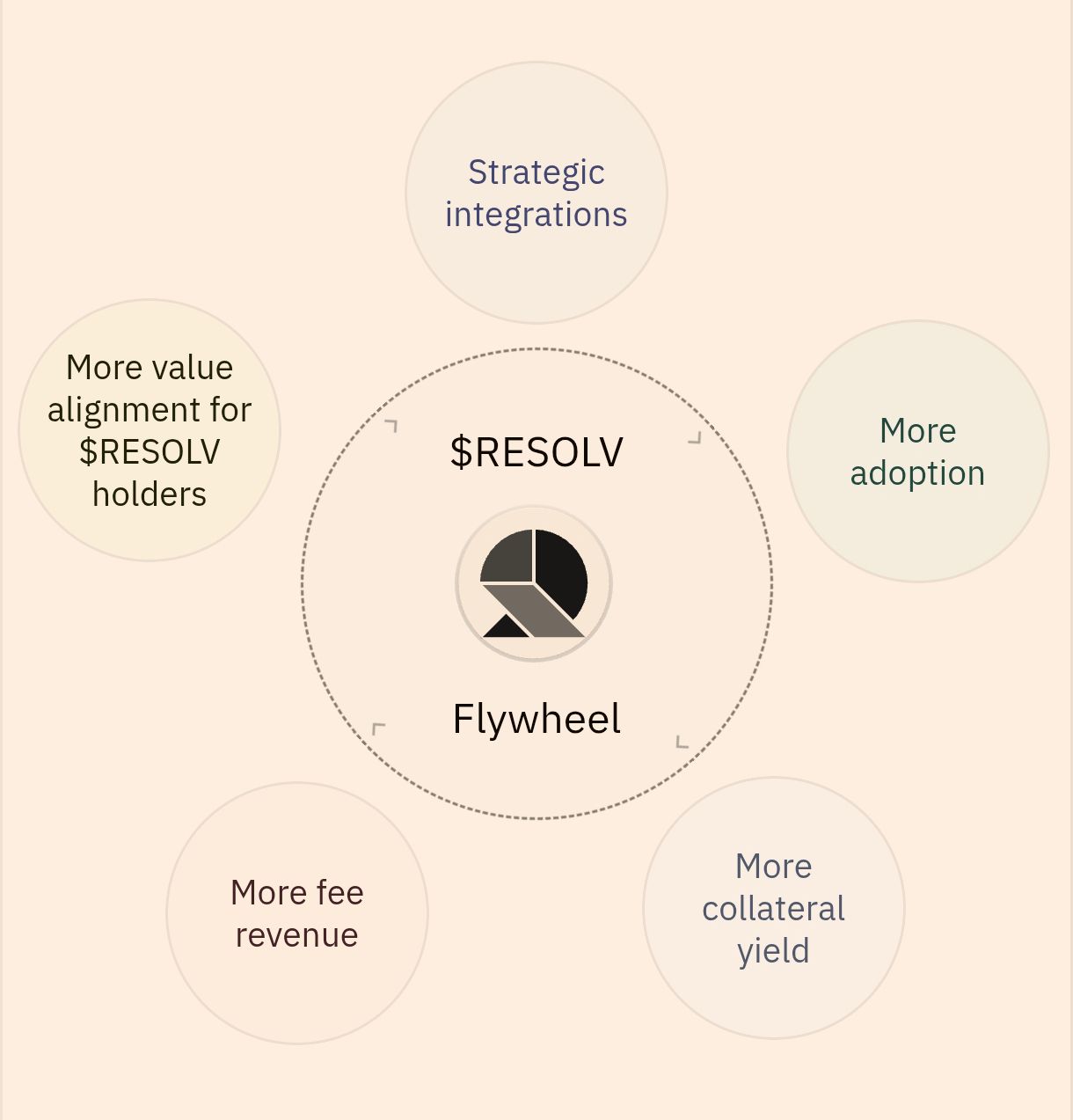

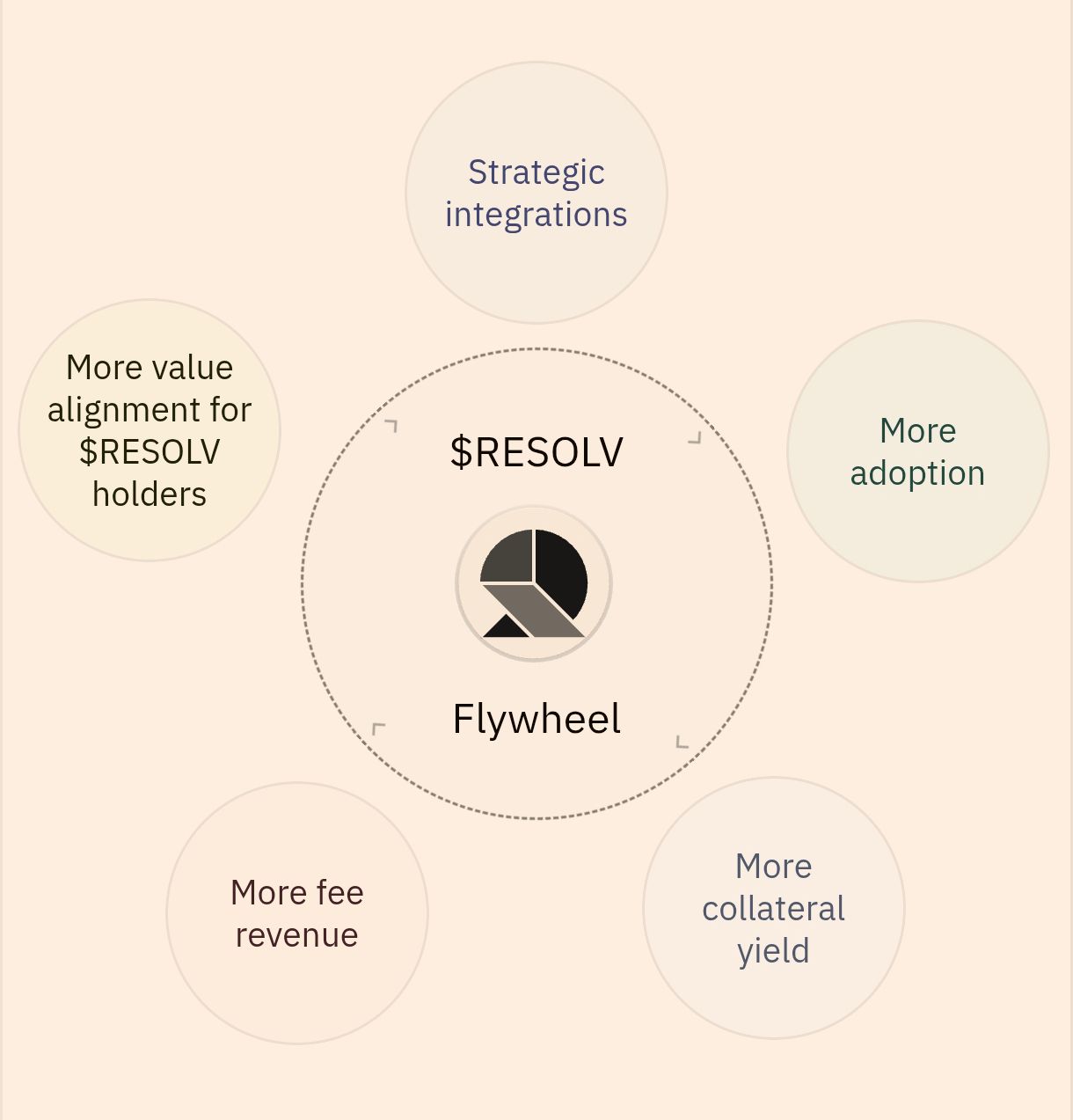

Utility-Driven Token Design With Long-Term Incentives

RESOLV is not merely a speculative asset. Its design embeds intrinsic utility into the fabric of the Resolv protocol. According to Resolv’s core team, the token will enable holders to:

- Participate in governance decisions, ensuring that token holders have a direct influence on protocol evolution and upgrade proposals.

- Access double rewards through liquidity incentives and farming programs.

- Unlock increased points multipliers, a gamified mechanic tied to Resolv’s broader reward structure.

- Benefit from long-term staking multipliers, a clear incentive for users to hold and stake their tokens over extended periods.

The governance component is particularly noteworthy. By empowering token holders to shape the protocol’s roadmap, Resolv is setting a precedent for participatory decentralization—something that’s often promised, but rarely delivered with true transparency.

TGE Registration: A Tight, Secure Window for Eligibility

The Token Generation Event, set to launch in early-to-mid May, will be preceded by a one-week registration window. Resolv notes that eligibility will extend to both Points Program participants and early platform users (termed “Resolv recipients”), offering broad access to the initial airdrop round.

In a proactive move to prevent gaming and manipulation, registrations will undergo a screening process aimed at detecting “witch attacks” and bot-driven abuse. The term “witch attacks” refers to Sybil-like behaviors—users creating multiple identities to drain disproportionate rewards from decentralized protocols.

This layer of defense is particularly critical in light of recent high-profile DeFi airdrop incidents, such as the EigenLayer registration loophole, which reportedly led to millions of tokens being concentrated in fewer than 100 wallets.

“We’ve learned from the industry’s mistakes,” said a Resolv core contributor who requested anonymity. “This isn’t just a token drop—it’s the foundation of a real economy. We need to protect that economy from malicious actors from day one.”

After registration, the token claim interface will remain open for 30 days, giving participants a reasonable window to collect their airdrop. This extended claim period is designed to maximize fairness and accessibility, especially for users across different time zones and bandwidths.

An Emerging Model for Sustainable Token Launches

The sophistication of Resolv’s tokenomics stands in contrast to many recent DeFi launches, where rushed token releases and unclear utility have led to volatility and user distrust. By publishing comprehensive token allocation details, embedding real utility, and prioritizing secure access, Resolv is attempting to rewrite the blueprint for ethical and effective token distribution.

Resolv’s rollout strategy reflects a broader shift in DeFi—away from hype-driven speculation and toward robust, transparent infrastructure. The combination of governance access, long-term staking rewards, and a meaningful security posture places the RESOLV token in alignment with what institutional-grade protocols are beginning to demand from DeFi governance assets.

As TGE registration approaches, tech-savvy investors, analysts, and developers alike will be watching how effectively Resolv executes its ambitious launch. Whether the protocol can maintain these high standards post-launch—particularly as tokens begin circulating—will ultimately determine whether RESOLV becomes a durable asset or just another experiment in tokenomics.

Post Comment