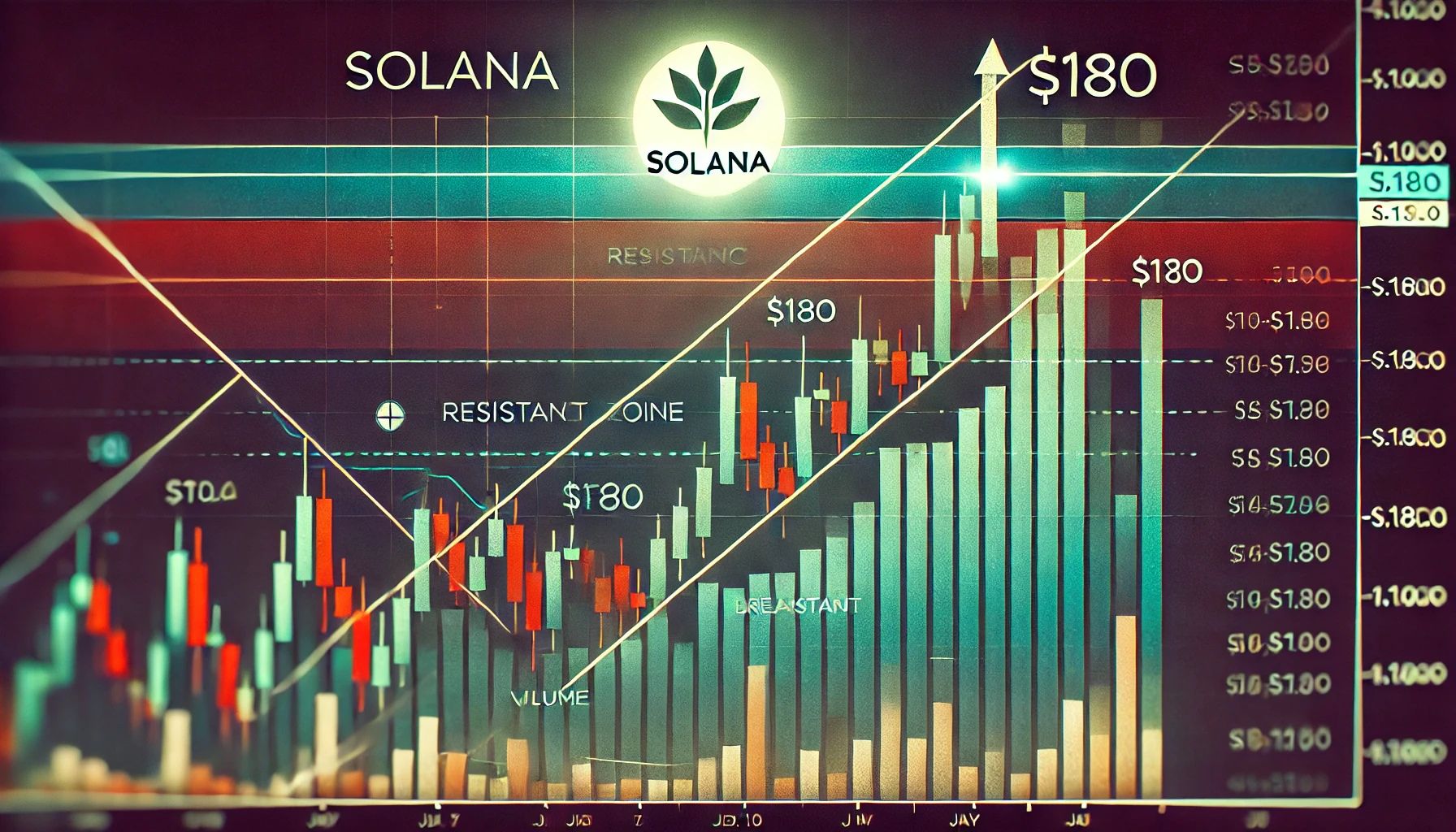

Solana Rallies Into Pivotal Zone – $180 Level Could Define Next Move

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana is gaining momentum once again, with price action pushing above the $175 level for the first time in weeks. The move comes as crypto markets roar back to life, fueled by Bitcoin’s push above $100K and Ethereum’s explosive rally past $2,500. Solana has surged more than 20% in the past week alone, signaling strong demand and a renewed bullish outlook from traders and investors alike.

Related Reading

Top analyst Big Cheds shared a technical analysis revealing that Solana is now making a strong advance into a key spot—the underside of the daily 200 moving average (DMA). The asset is also approaching a lower high around the $180 mark, which previously acted as resistance during the last failed breakout attempt. Cheds notes that reclaiming this zone would be a significant win for bulls, potentially triggering a sharp continuation toward new highs.

Market sentiment is turning optimistic across the board, and Solana’s technical setup reflects that shift. As price approaches the 200DMA, all eyes are on whether SOL can hold this momentum and break through key levels to join the broader market rally. The coming days will be crucial for confirming a full trend reversal.

Solana Approaches Pivotal Level As Bulls Eye Breakout

Solana is showing renewed strength after a clean breakout above the $160 resistance zone, a level that had capped price action for several weeks. The surge has brought SOL into a critical region that could act as a pivot point—either igniting a fresh bullish rally or marking a temporary top before a retrace.

As global tensions between the US and China and broader macroeconomic uncertainties linger, the crypto market remains exposed to sudden sentiment shifts. However, recent price action in Solana, along with Bitcoin and Ethereum, suggests that investors are increasingly optimistic about a continued market recovery.

Solana’s current structure reflects that optimism. The asset is now testing the underside of its daily 200 moving average, a level often viewed by traders as a trend-defining indicator. A successful push above this moving average would add further confidence to the bullish thesis. At the same time, Solana is approaching a lower high near the $180 zone, where the price was previously rejected in March. Cheds points to this convergence as a crucial area: a breakout here could mark the beginning of a larger reversal pattern.

Still, risks remain. A rejection at the $180 level could reinforce resistance and trigger a pullback toward the $160 support, especially if macro conditions worsen or profit-taking sets in. For now, however, bulls appear to be in control, and the technical landscape supports a potential continuation—if momentum holds.

Related Reading

Technical Levels: Price Action Shows Strength

Solana (SOL) is exhibiting strong momentum as it trades at $176.41, advancing toward a crucial resistance area around the $180 level. The daily chart shows that SOL has surged rapidly from April lows, breaking above both the 200-day EMA ($161.67) and approaching the 200-day SMA ($181.10), a key area that could determine the next major trend.

This zone acted as support and resistance multiple times in the past, particularly during Q4 2024 and early 2025. Now, as price returns to this range, it becomes a potential pivot point. If bulls can sustain pressure and close above $181.10 with volume confirmation, it may trigger a continuation toward $200 and possibly retest February highs above $260. However, failure to break above this range could prompt a rejection and consolidation below the 200 SMA.

Related Reading

Volume has picked up significantly over the last few days, indicating rising interest and participation from traders. This is a constructive sign as Solana attempts to reclaim higher ground. For now, the trend remains bullish, but eyes are on the $180–$185 resistance zone to confirm whether SOL has the strength to continue its breakout or faces a short-term pullback.

Featured image from Dall-E, chart from TradingView

Post Comment