A Comprehensive Guide To Crypto SIPs

Systematic investing is no longer confined to traditional finance — it’s finding a strong foothold in the world of crypto. Approaches like SIPs, originally designed for stock markets, now offer investors a disciplined way to accumulate digital assets over time. With consistent contributions and the power of compounding, this method helps smooth out market volatility while keeping your portfolio focused on long-term growth.

What is SIP Investment?

A Systematic Investment Plan (SIP) allows you to invest a set amount periodically—usually every month—rather than making a one-time investment. This approach minimizes the effect of market volatility by distributing your purchases across different price points. Through rupee cost averaging, you automatically acquire more units when prices dip and fewer when they rise, gradually reducing your average investment cost. Ideal for long-term investors, SIPs provide a disciplined and hassle-free way to grow wealth without the pressure of perfect market timing.

What is SIP in Crypto?

Crypto investing is evolving from quick, impulse-driven trades to structured, purpose-led strategies. A Crypto SIP enables you to automatically invest in selected digital assets at regular intervals—be it weekly, monthly, or as per your chosen schedule.

By taking timing out of the equation, this approach encourages steady portfolio growth and disciplined investing. It’s an efficient, low-effort way to stay committed to long-term wealth building while staying unfazed by short-term market swings.

Read more: Crypto vs. Stocks

How Does SIP in Crypto Work?

Imagine you’re investing in a token called ABC, currently priced at ₹1,000. By investing ₹1,000 every month, you’d buy 1 token initially. If the price climbs to ₹1,100 the next month, you’d receive about 0.9 tokens, and if it falls to ₹900 the following month, you’d get around 1.1 tokens.

This process—known as rupee cost averaging—helps even out market volatility through consistent investing. It takes away the stress of guessing the right entry point and offers a smoother start for beginners. Many platforms now extend this concept through coin sets—curated collections of crypto assets that function like mutual funds. These bundles provide instant diversification, helping investors balance risk while growing a well-rounded crypto portfolio.

Read more: Crypto Trading Strategies

What are the Benefits of SIPs in Crypto?

Convenience

A crypto investment plan makes managing your portfolio much more convenient. You do not have to track the market daily or try and predict the best time to buy a token. Instead, your exchange will automatically take care of such inconveniences.

Dollar Cost Averaging

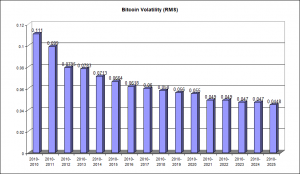

This principle is the main advantage of using SIPs over lump sum investments. Dollar Cost Averaging (DCA) reduces your exposure to volatility and allows you to enter the market at multiple price points. Your risk of sudden market movements is lowered considerably.

Compound Interest

Many long-term investors say staying invested in the market is the most important factor in high returns. Crypto SIPs allow you to benefit over time, as you can reinvest your earnings and grow your wealth.

SIP Investment Strategy in Crypto

Increase Investments Over Time

Increasing the amount you invest in SIPs is highly beneficial in the long run. Ideally, your savings should be a percentage of your income, which allows them to scale along with your paycheck.

Do Not Withdraw Early

Sometimes, you may need to withdraw your investments to cover other expenses. However, this should be a last-case scenario as time in the market is essential to earning through SIP. If you must, try to withdraw when prices are high so you do not lose out on returns.

Track Your Portfolio Regularly

While you do not have to track the market on a daily basis, it is crucial that you manage and analyse your portfolio every once in a while. This helps you identify whether the portfolio is meeting your benchmarks, or if you need to switch your crypto investment strategy.

Conclusion

Crypto SIPs present an easy and effective path to long-term wealth creation. Whether you’re a beginner or a seasoned investor, making consistent contributions helps your portfolio expand steadily through the power of compounding. The real strength of this approach lies in discipline—staying consistent, ignoring short-term volatility, and allowing your investments the time to reach their full potential.

You can learn more about crypto on ZebPay blogs. Begin your crypto trading journey today with ZebPay!

Disclaimer:

Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Each investor must do his/her own research or seek independent advice if necessary before initiating any transactions in crypto products and NFTs. The views, thoughts, and opinions expressed in the article belong solely to the author, and not to ZebPay or the author’s employer or other groups or individuals. ZebPay shall not be held liable for any acts or omissions, or losses incurred by the investors. ZebPay has not received any compensation in cash or kind for the above article and the article is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information.

Post Comment