Gold vs. Cryptocurrency: Comparing Alternative Investment Options

Investors are seeking alternative destinations to conventional stocks and bonds for portfolio diversification. Gold and cryptocurrency are among the most popular alternatives. Each has its own set of characteristics, but one thing is certain: both present good possibilities for investors to consider.

In this post, I’ll go over gold vs. cryptocurrency as an alternative investment and compare the two . By the time you finish this post, you will be better educated to determine which of the two alternatives is suited due to your objectives and characteristics.

Gold vs. Cryptocurrency: Comparing Alternative Investment Options

Historical Significance of Gold

Gold has been one of the oldest and most reliable symbols of wealth. Its rarity and intrinsic value, not to mention its malleability, and corrosion resistance had increased the metal’s trustworthiness across various cultures and time periods. It is linked to history in terms of its usage for coinage, jewelry, as well as the central banks’ reserve currency. Today, it is known as one of the last ‘safe havens’.

The Emergence of Cryptocurrency

Contrastingly, cryptocurrency is a newcomer to the spectrum of securities. Cryptocurrency first appeared in 2009 with the introduction of Bitcoin, a digital electronic currency independent of centralized banking institutions.

In fact, cryptocurrencies have a decentralized structure and are processed using blockchain technologies that allow transactions between participants without intermediaries in a secure manner. Cryptocurrencies are already renowned among both investors and technologists, as the market includes thousands of distinct digital currencies.

Understanding Gold as an Investment

The investment attractiveness of gold is based on its fundamental characteristics. It is impossible to depreciate gold so much as, for example, the national currency by increasing the emission volumes of this currency . The gold supply is limited at a certain level, and if its production increases, it only provokes a decrease in its price.

In response to investment demand, gold extraction also changes, but in general, gold is a reliable tool for preserving money from inflation. Gold Market Trends and Influencing Factors Requirements, and Priority Factors .

The value of gold is influenced by: global economic conditions, geopolitical events, and market demand.

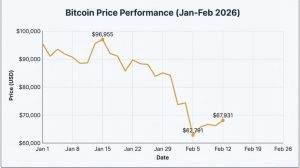

Cryptocurrency as an Investment

Cryptocurrency markets are highly volatile, with prices able to swing widely at any time. While this can be an opportunity for play, it can also be a risk for investing oneself. The ability of making returns can be enticing, but the risk of accurate prediction must be carefully managed.

The regulatory landscape of cryptocurrency is highly varied. Some countries get innovative and liberal with digital assets, while others put strict or not -so-legislation into place. Legal changes can change the value and availability of cryptos, so investors must keep up with the news regarding various jurisdictions.

Comparative Analysis

Risk and Reward Potential

Gold has been considered a stable asset class, giving minimal but frequent returns throughout a while. In contrast, cryptocurrencies can provide excellent returns but come with more significant risks attached to them in terms of market volatility. Thus, investors should assess their risk appetite and investment time frame when deciding which option to choose.

Liquidity and Accessibility

Gold is also highly liquid and widely available in the form of bullions, coins, and exchange-traded funds . In the same way, cryptocurrencies are easily accessible and can be traded via an online exchange or kept in a digital wallet.

Portfolio Diversification and Strategy

Hedge with Gold

Use gold as a hedge against inflation and an economic recession. Having some gold in the portfolio may reduce the overall volatility. It provides exposure to a different kind of asset class, compensating for other highly volatile stocks.

Allocate to Cryptocurrency

Cryptocurrency can provide a high return on an investment. When used smartly in a diverse portfolio, one can benefit from its spike without placing the whole investment at risk.

Tax Implications and Considerations

Taxation of Gold Holdings

The tax implications of gold differ based on the form it is held in, as well as the amount of time it is held. Gold held by most jurisdictions is first subjected to a capital gains tax once the individual sells it in a manner that turns a profit.

Taxation of Cryptocurrency Investments:

When the investor sells their cryptocurrency for a profit, it is also first subjected to a capital gains tax. Furthermore, the majority of jurisdictions mandate that all of their cryptocurrency transactions be reported for tax reasons. For the exact answer, consult a tax advisor.

Future Outlook and Trends

Gold’s role in the future economy

Gold might not be an everyday currency today, but its unique nature as a tangible asset and the limited availability due to its rarity mean that it is going to have a role in the future economy. Uncertainty over the future of financial systems suggests that gold is going to be a store of value in any form.

The evolution of cryptocurrency today

crypto is mostly a speculative investment rather than a currency. However, the perspective for innovation is quite possible given the rapid development of blockchain technology, which allows for advanced applications than mere currency.

Real-World Use Cases

Gold’s Applications

Gold’s Uses outside of Investment Gold is also used in everyday technologies and industries. It is a prevalent metal in electronics, dentistry, aerospace, etc., due to its conductivity and corrosion resistance.

Cryptocurrency’s Utility

Cryptocurrency’s Utilizing Power Cryptocurrency is actively used in finance, supply chain, and Decentralized Finance to create innovative solutions in other industries.

FAQ: Issues to be Further Discussed

What are the risks of investing in gold and cryptocurrency?

For gold, price fluctuations, which occur dependent on global economic events and geopolitical processes, are typical. For cryptocurrency, the risk of use as a financial pyramid, hacking, and the influence of external factors, including the legislative ones, are among the most pressing problems.

What is more profitable to invest in the long term, gold, or cryptocurrency?

Gold is recommended for investment due to its stability and serving as a tool for hedging and a means to prevent inflation. Despite the fact that cryptocurrency has higher profitability, it may be recommended to investors with higher risk thresholds.

How to start investing in gold or cryptocurrency?

Gold is bought through the purchase of metal in physical form, namely bullion or coin, as well as through the purchase of shares in in-stream companies or gold ETFs. Cryptocurrency is predominantly purchased through trading exchanges, upon the opening of a digital wallet.

What brought me to this decision?

Gold ensures stability, while cryptocurrency provides the investor with the opportunity to choose a high-return platform. Hence, I decided to pull up my concerns for life support and new blockchain technologies with investment in this method.

How to secure investments from market fluctuations?

The portfolio should be diversified between gold investment and cryptocurrency today to minimize the risk of opening and realizing potential opportunities within this sector.

Can I have a retirement account with gold and cryptocurrency?

In some jurisdictions, it is possible to have gold and cryptocurrency in a self-directed individual retirement account or similar. The broker chooses the option which the client has access to.

Conclusion

Gold vs. cryptocurrency in the arena of alternative investments is a debate with a complex character. The two assets have their unique advantages and corresponding risks. The former is known for millennia as a safe haven that wards off volatility and inflation, thus being appropriate for conservative individuals. The latter is viewed as a high-growth asset with breakthrough technology that attracts more innovative and ambitious buyers.

Overall, the choice between gold and cryptocurrency is determined by an individual’s riskiness, investment targets, and strategy. It is also possible to pair the two alternative assets in one’s portfolio to maintain a balanced level of exposure and growth opportunity. In any case, being aware of market trends, regulatory concerns, and possible novelties is required to make a rational choice.

Post Comment