Coinbase Announcement Signals Institutional Shift –

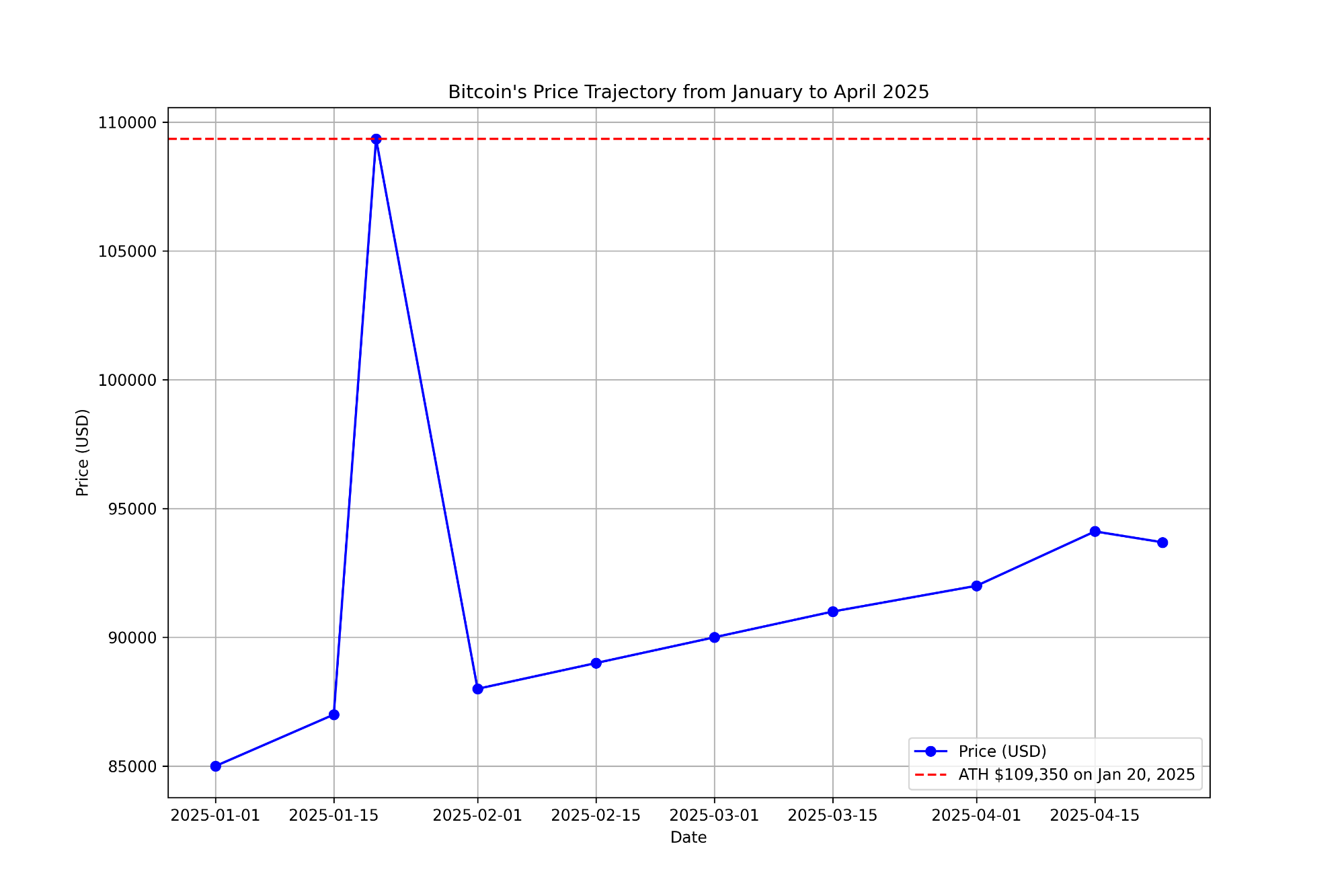

Sovereign wealth funds and institutional investors are diving into Bitcoin, driving a rally even as retail traders exit through exchange-traded funds and spot markets, a Coinbase executive revealed on CNBC. The announcement, made on April 23, 2025, underscores Bitcoin’s growing appeal as a hedge against inflation and economic uncertainty, with its price recently surpassing $90,000, according to Yahoo Finance data from April 22.

John D’Agostino, head of strategy at Coinbase Institutional, told CNBC that Bitcoin is behaving like gold, highlighting its scarcity, immutability, and portability as a non-sovereign asset. “Bitcoin is trading on its core characteristics, which again are similar to gold,” D’Agostino said. He noted that sovereign entities, such as those in El Salvador and Bhutan, have already adopted Bitcoin for national reserves, a trend now expanding to other institutional players. This comes as Bitcoin’s market capitalization exceeds $1.85 trillion, surpassing Google and ranking among the top five global assets, per Coinbase data.

COINBASE JUST SAID SOVEREIGNS ARE BUYING #BITCOIN 👀

HERE WE GO!!! 🚀 pic./bMJ4IQp4Oc

— Vivek⚡️ (@Vivek4real_) April 23, 2025

The news sparked a wave of reactions on social media platforms like X, where users celebrated the bullish signal. “Here we go!!!” posted user Vivek, linking to the CNBC segment. However, not all responses were positive. User Robby Hartt questioned the freshness of the news, while others, like Crypto with Ankit, noted that such institutional buying has become a recurring theme without surprising the market.

Market analysts see this as part of a broader shift in the crypto landscape. Bitcoin’s recent rally aligns with a weakening U.S. dollar, pushing investors toward alternative assets. According to Cointelegraph, retail investors have been selling off through ETFs, while institutions are accumulating, a dynamic that has bolstered Bitcoin’s price. The total crypto market cap has risen to $2.82 trillion, a 9.67% increase from last week, Coinbase reported on April 23.

Industry voices offered mixed perspectives. “Regulatory clarity and institutional adoption are key drivers,” said Michael Carter, a crypto analyst at Blockchain Insights. “But retail exits could signal short-term volatility.” Meanwhile, Coinbase’s stock (COIN) surged 10.3% on April 22, reflecting investor confidence in the firm’s role as a bridge for institutional crypto adoption, per Yahoo Finance.

Despite the optimism, challenges remain. Sovereign adoption raises questions about regulatory oversight, especially as nations like the U.S. and EU tighten crypto frameworks, according to Cryptowisser. Some governments view Bitcoin as a threat to monetary control, opting instead for Central Bank Digital Currencies (CBDCs). Additionally, the environmental impact of Bitcoin mining continues to draw scrutiny, potentially complicating broader adoption.

Looking ahead, analysts expect more sovereign entities to disclose Bitcoin holdings, potentially fueling further price gains. However, global regulatory developments and market sentiment will play a critical role. “Sovereign crypto adoption is no longer theoretical—it’s happening now,” a Cryptowisser report stated, emphasizing the need to balance innovation with oversight.

The Coinbase revelation marks a pivotal moment for Bitcoin, cementing its status as a global asset class. As institutional interest grows, the crypto market braces for potential shifts in regulation and adoption. Investors and policymakers alike will be watching closely to see how this trend evolves in the coming months.

Post Comment