Does It Really Work or Is It Just a Myth?

Scalping is one of the fastest ways to trade the market. It involves taking small profits from quick price movements, often within minutes.

While many traders rely on indicators like RSI or moving averages for scalping, the MACD remains one of the most debated tools.

Some say it’s too slow for scalping. Others claim it works perfectly if you know how to read it.

So, does scalping with MACD really work? Let’s find out.

Post Summary

What Makes the MACD Special

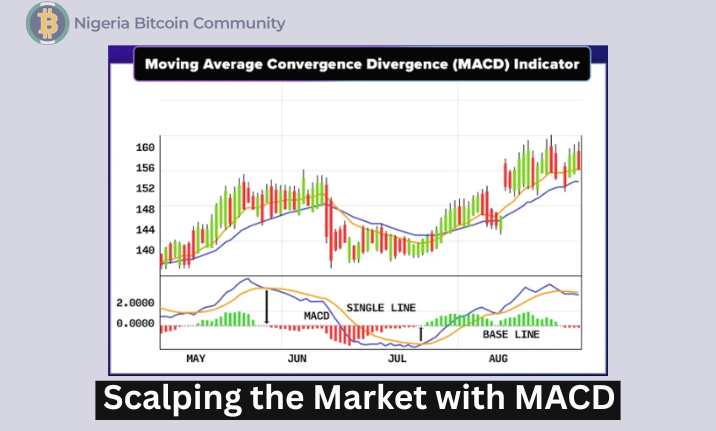

The MACD, short for Moving Average Convergence Divergence measures momentum and trend direction.

It uses two exponential moving averages (typically 12 and 26 periods) to show when momentum is shifting.

When the faster EMA (12) crosses above the slower one (26), it signals bullish momentum. When it crosses below, bearish momentum builds.

The difference between these two averages is plotted as the MACD line, while a 9-period average of that line forms the signal line.

In simple terms:

When the MACD line crosses above the signal line, it hints at a short-term buy.

When it crosses below, it suggests a short-term sell.

For swing or day traders, these signals work beautifully. But for scalpers who make dozens of trades in an hour, timing is everything, and that’s where challenges appear.

Want to Master Crypto & Forex Trading?

Jude Umeano, one of Nigeria’s most respected and successful traders just launched Afibie, a mentorship platform built to help you earn your first $10,000 and beyond from the markets.

Whether you’re new or stuck at break-even, this is your next step.👉 Visit Afibie now.

The Problem With Using Default MACD Settings for Scalping

The default MACD (12, 26, 9) works well for identifying medium-term trends. But for scalping on 1-minute or 5-minute charts, it reacts too slowly.

By the time the crossover happens, the move may already be over.

For instance, imagine trading EUR/USD on a 1-minute chart. Price surges sharply, but the MACD lines only cross after three candles.

By that point, the short-term momentum is fading. If you enter late, you risk buying the top or selling the bottom.

This lag is why many scalpers tweak the MACD settings to make it more responsive.

Best MACD Settings for Scalping

To make MACD react faster, you need shorter EMAs. The goal is to capture quick shifts in momentum without waiting for a full crossover to form.

Common fast-scalping settings include:

- MACD (6, 13, 5)

- MACD (5, 15, 4)

- MACD (8, 21, 5)

These settings reduce lag and make the indicator more sensitive. But sensitivity cuts both ways, it gives earlier signals, but also more false ones.

The trick is to pair the MACD with another filter, like a trend direction tool or support/resistance zones, to avoid taking trades against the broader move.

Example: MACD Scalping in Action

Let’s take a practical example using the MACD (6, 13, 5) setting on the BTC/USDT 1-minute chart.

- Price is trending upward, forming higher lows.

- The MACD histogram turns positive, and the MACD line crosses above the signal line

- You enter a quick long position at the start of the candle after the crossover

- You set a small stop loss (0.2%–0.5%) and aim for a 0.5%–1% profit

If momentum continues, you grab a small win. If it fades, your loss is tiny. Repeat this setup multiple times during a strong trending session, and small wins can add up.

This approach works best in volatile periods like the London or New York session when the market moves fast enough for momentum to follow through.

Why Scalping With MACD Fails for Some Traders

While the method works, it’s not foolproof. Here’s why many fail with MACD scalping:

- They use it in a ranging market. MACD gives false signals when price chops sideways.

- They enter late. The MACD crossover lags behind price.

- They ignore higher timeframes. Scalpers who trade against the dominant trend often get caught in pullbacks.

- They trade every signal. The best scalpers wait for confluence for example, a MACD signal aligning with price breaking a micro-level.

Scalping requires lightning-fast execution and discipline. Even with perfect settings, hesitation or overtrading can ruin the system.

How to Improve MACD Scalping Accuracy

To make MACD scalping truly work, use it as part of a complete system, not in isolation.

You can improve accuracy by:

- Combining MACD with RSI or VWAP to confirm entries

- Checking trend direction on higher timeframes (e.g., the 15-minute chart) before taking 1-minute scalps

- Waiting for both MACD crossover and histogram confirmation

- Avoiding low-volume sessions when price movement is weak

A simple yet effective combo is MACD (6, 13, 5) + 50 EMA trend filter. When price is above the 50 EMA, you only take bullish crossovers. When below, you only take bearish ones.

Conclusion: Does Scalping With MACD Really Work?

Yes! But only if you understand how it behaves. The MACD is not a pure scalping tool by design, yet with the right settings, context, and confirmation, it can deliver excellent results.

The key lies in adaptation. You can’t use swing-trading settings on a 1-minute chart and expect instant accuracy.

But with faster EMAs, clear market structure, and disciplined exits, MACD can absolutely become a profitable part of a scalper’s toolkit.

Scalping with MACD works when you treat it like a timing assistant, not a signal generator.

It helps you visualize momentum shifts, but you still need strong risk control and quick decision-making.

The indicator alone won’t make you money, your consistency will. Master the pace, refine your settings, and the MACD can become one of your sharpest tools in the fast lane of trading.

Have you ever tried scalping with MACD? Share your experience in the comments below, and don’t forget to share this post if you found it helpful.

Also Read: Best MACD Settings for Every Timeframe

Post Comment