When “Alt Season” Arrives, Bitcoin Waits at the Finish Line

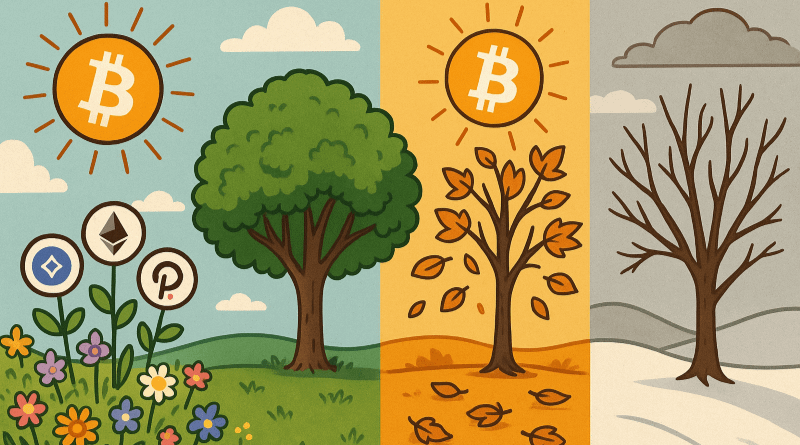

Every few cycles, the phrase “alt season” makes its way back into the headlines, into Twitter threads, and into the fever dreams of traders convinced they’ve found the shortcut to outsized gains. It’s a catchy phrase. It suggests a kind of inevitability: that there’s a distinct season where altcoins will outperform Bitcoin, suck in capital, and rewrite the hierarchy of the market.

But what does “alt season” actually mean? And more importantly, what has history shown us about how it ends?

Defining “Alt Season”

In crypto slang, “alt season” refers to a period where alternative cryptocurrencies—everything that isn’t Bitcoin—see massive price increases, often outperforming BTC on a percentage basis.

Traders rotate out of Bitcoin into ETH, Solana, meme tokens, or the latest yield-farming project, chasing short-term multiples. Charts flood with green, exchanges flood with volume, and social feeds flood with “this time is different.”

The logic of alt season is simple: when Bitcoin stabilizes or cools after a rally, capital gets restless. Speculators go hunting for risk. They start bidding up projects with higher volatility and lower liquidity, because that’s where 10x dreams live. Bitcoin becomes the yardstick, but alts become the thrill ride.

The Historical Record

Alt seasons are not new. They have punctuated every Bitcoin bull run:

2013: Bitcoin’s explosive rise was accompanied by surges in Litecoin and other early forks. They faded into irrelevance. Bitcoin didn’t.

2017: The ICO mania lit up thousands of tokens, each promising to disrupt industries. By 2018, 90% of them were worthless, while Bitcoin survived a brutal drawdown and returned stronger.

2021: “DeFi summer” and NFT mania pushed Ethereum gas fees sky-high and created paper millionaires overnight. Then the bubble popped. Liquidity drained. Projects vanished. Bitcoin marched on to a new all-time high in 2024.

The cycle is almost comically predictable: hype, rotation, blow-off top, collapse, capitulation, and capital flight back to Bitcoin. Each time, altcoins promise the end of Bitcoin’s dominance. Each time, they prove to be leveraged bets on Bitcoin’s cycle rather than replacements for it.

Why Alt Seasons Happen

To dismiss alt season entirely as “noise” would miss something important. Alt seasons exist because human nature doesn’t change. Greed, fear of missing out, and the eternal hunt for a quick 100x guarantee that traders will gamble. Exchanges feed this with shiny new listings. VCs pump it with marketing budgets. And for a brief moment, the illusion of a new paradigm is created.

But illusions don’t last. Bitcoin is not just another asset in the casino; it is the base layer of digital monetary reality. When the music stops and risk appetite dries up, Bitcoin remains liquid, secure, and antifragile. Altcoins cannot claim that.

What Alt Season Really Means

So what is “alt season,” truly? It’s not a threat to Bitcoin—it’s a stress test of conviction. It’s a sideshow that reveals just how far traders will chase speculative excess before gravity brings them back to reality.

Alt season means Bitcoin has already done the hard work: it has rallied, drawn in new participants, and created enough wealth that gamblers are willing to branch out. Without Bitcoin leading the way, there is no “season” for the alts to piggyback on.

The Lesson of Every Alt Season

Alt seasons end the same way: with bagholders realizing too late that their “flippening” token was a mirage, and with Bitcoin consolidating power. Each cycle leaves behind a new graveyard of tickers, while Bitcoin mines another halving, pushes another all-time high, and onboards another wave of long-term holders.

The real season to watch is not alt season. It’s Bitcoin season. And unlike the carnival of altcoins, Bitcoin season never ends—it just compounds, year after year, block after block.

So the next time “alt season” trends, smile. Let the traders have their fun. But remember: when the dust settles, Bitcoin is always the last asset standing. And that’s not a season—that’s permanence.

Post Comment